HEX

HEX

the first coin to have two independent security audits

HEX finally aired, marking the latest project of YouTube's colorful personality Richard Heart. On December 2, 2019, HEX has completed its snapshot, and the token is now in circulation. HEX describes itself as a blockchain deposit certificate - an interest payment service traditionally offered by banks.

This project is divisive: for detractors, HEX is a referral scheme which is unlikely to get value. It has also been advertised in questionable ways, such as front page advertisements on Pirate Bay. But for its supporters, HEX is an opportunity to get free gifts without upfront costs. However, HEX is still in its infancy - this is the prospect.

What is HEX?

HEX is basically a contract that pays interest to users who risk their tokens. Users who lock a larger amount of HEX will get the most rewards (as will users who do it for a longer period of time). In addition, revenue will be affected by overall betting activity - the average reward will be higher if less than the total HEX supply is at stake.

Circulation has begun: Bitcoin holders participating in the HEX snapshot now claim their HEX tokens and have 50 weeks to do so. Although snapshot participants can claim tokens for free, it is also possible to buy HEX tokens - but, as is the case with new cryptocurrency, HEX is naturally a risky investment.

HEX depends on inflation as a source of appreciation - like most cryptocurrency. Although the HEX's FAQ recognizes that this is the problem, it also promises that the HEX will "deflation in USD prices when the value of the HEX rises." However, because HEX has not yet reached the market value needed to achieve deflation, this is a difficult order.

How does HEX work?

While the analogy of bitcoin miners is useful for explanation, in reality, miners do not have participation in HEX. Replacing it is a staker maker. When risking, the investor promises to hold the HEX for a certain amount of time. Doing so, the interest credit on the percentage of HEX is at stake. This percentage return depends on how many HEX holders are at stake at one time. If only 1% of shareholders, return on investment (ROI) per year can exceed 369%. If 10% are shareholders, the average ROI for stakers will be reduced to 36.9%, and so on. If a maximum of 99% shareholders are HEX, a minimum of 3.69% ROI will still be available for betting makers.

The longer the bet is held, the more bonuses received. For example, Hex rewards investors with a 20% bonus share per year additional share commitment, paid on all stock commitments for one week.

The minimum time that a holder can bet for a stand is seven days, with a maximum hit of up to 50 years. While a stake has been created and is in the process, the holder cannot add, subtract, or modify the length or number of stakes. A stake can be terminated early through a protocol known as the "Emergency End Post." However, holders are charged with terminating the stake early - equivalent to a gain of half a week of commitment.

When betting through the Hex.win website , interest payments are allocated in HEX on the expiration date of the betting period. After this period ends, the holder can reassemble or remove tokens.

The HEX project aims to create interest-bearing savings accounts in the cryptocurrency space while eliminating the need for trusted third parties. The basic features of the project are greatly influenced by traditional Deposit Certificate accounts. Once launched, all project functionality will be handled by smart contracts instead of companies / organizations. The base interest rate offered by HEX is 3.69% per year, with the possibility of bonus interest for a longer locking period.

Is HEX Really Active?

HEX founder, Richard Heart, boasted that HEX was one of Ethereum's most active smart contracts . In three days, HEX contracts made more than 52,000 transactions. However, as Etherscan points out, many transactions in HEX contracts have no monetary value - perhaps due to the fact that the snapshot has provided HEX for free.

Some users seem to buy HEX tokens: being traded in very low volumes on Etherdelta and Bidesk. However, this is not enough to give HEX a detected market value. Etherscan displays the price of HEX as $ 0.00, and projects need to become more prominent before being listed on market aggregators, such as CoinMarketCap.

Is HEX Valid?

The most controversial aspect of HEX is its referral scheme. The HEX FAQ claims that this is not a Ponzi scheme, because it can always make payments. He also claimed that it was not a pyramid scheme, because the referral was only intended to last for 50 weeks. If this is true, HEX is not a scam - only risky investments.

Another problem is the fact that the HEX "origin address" generates copies of gifts made by other users. Critics claim that Heart stands to get the most wealth out of this - although Heart itself implies that the original address is not under its control. In any case, this lack of transparency might be a concern for some people.

Finally, the HEX relies on a combination of betting and inflation which is largely unproven. He also acknowledged that his future value would come from replacing gold and credit cards for several years - an ambitious goal, to say the least. Given that more prominent platforms such as Cardano and Tezo already offer prizes, there are safer options for inv

Make the most HEX.

- Send your ETH to the AA lobby.

- If you hold Bitcoin in the photo, FreeClaim is with it. Then sell BTC for ETH and send it to the AA lobby.

- Choose 10 years for your 90% AutoStake and HEX in your wallet, get 3x the lowest possible share price.

- When the AA lobby you join closes at the end of the day, come out of the lobby with your HEX and pair it for 10 years.

- When BigPayDay reaches day 353, you will get the biggest part of what you can by risking early, long and big

How to maximize profits?

- Get great deals on HEX right from the start of Adoption Amplifier (AA) or FreeClaim.

- Get the most shares for the HEX you are betting on by being early. StakeSharePrice just goes up.

- Longer bet (Increase stock up to 3x.)

- Bigger bets (Increase stock to 1.1x.)

- Refer people (get 20% above HEX each person they receive from AA from FreeClaim.)

- Get people to FreeClaim, increase adoption and Virality and CriticalMass bonuses.

- Make people interested, delete HEX from circulation.

- Get people to buy HEX.

HEX TOKEN?

The first high-interest blockchain certificate of deposit designed to be taller, faster, and maintain its value ... built on Ethereum as an ERC20 token.

Anyone who holds Bitcoin on December 1, 2019 (Snapshot) will be able to claim 10,000 Free Hex Tokens for every Bitcoin they have. 💁♂️

In other words, if you have a lot of Bitcoin in your wallet ... You will be able to claim lots of Free HEX by logging in using your key! 🤑

All "Crypto Enthusiasts" will also be able to get Hex Tokens now by sending Ethereum (ETH) to the HEX Adopting Amplifier.

The longer you wait to claim and bet, the less coins you will get. So, if you want the "Most Gainzzz" of your Free HEX, you should claim ASAP!

In the last 24 hours since it was launched, there have been more than 3+ million dollars (20,543+) ETHs that have now been sent to Adoption Amplifiers!

Click the link of my ambassador to get a 10% bonus when you claim for free or convert ETH to HEX!

This is not financial advice and please do your own due diligence before doing anything in the crypto room.

The first high-interest blockchain certificate of deposit designed to be taller, faster, and maintain its value ... built on Ethereum as an ERC20 token.

Anyone who holds Bitcoin on December 1, 2019 (Snapshot) will be able to claim 10,000 Free Hex Tokens for every Bitcoin they have. 💁♂️

In other words, if you have a lot of Bitcoin in your wallet ... You will be able to claim lots of Free HEX by logging in using your key! 🤑

All "Crypto Enthusiasts" will also be able to get Hex Tokens now by sending Ethereum (ETH) to the HEX Adopting Amplifier.

The longer you wait to claim and bet, the less coins you will get. So, if you want the "Most Gainzzz" of your Free HEX, you should claim ASAP!

In the last 24 hours since it was launched, there have been more than 3+ million dollars (20,543+) ETHs that have now been sent to Adoption Amplifiers!

Click the link of my ambassador to get a 10% bonus when you claim for free or convert ETH to HEX!

This is not financial advice and please do your own due diligence before doing anything in the crypto room.

HEX Sales Token:

Acceptable currencies: ETH, ATX

Harga Token: 1 ETH = 60.000 HEX / 1 ATX = 12 HEX

Total number of tokens generated: 14,000,000,000 HEX

Hard Cap: 100.000 ETH

Soft Cap: 20,000 ETH

Presales: 1 Sep 2018 ~ 14 Sep 2018 (total of 14 days)

Minimum amount: 50ETH / 250,000ATX

Discount rate: 30%

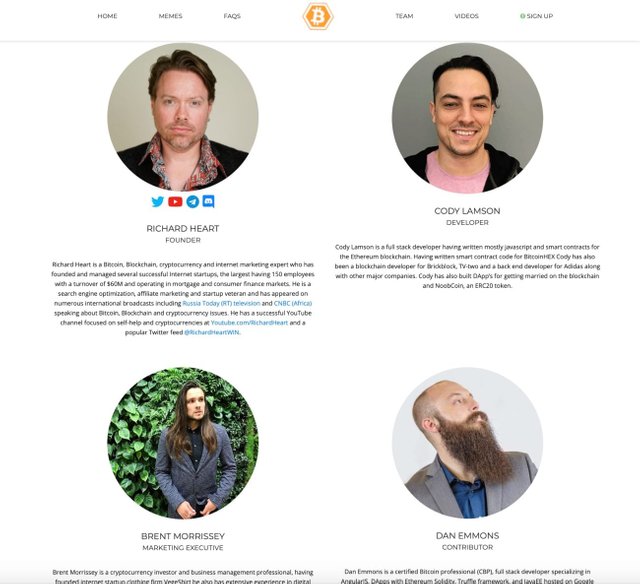

tim

For more information, please visit the link below:

WEBSITE: https://hex.win

TWITTER: https://twitter.com/HEXCrypto

FACEBOOK: https://www.facebook.com/HEXcrypto

MEDIUM: https://medium.com/hex-crypto

TELEGRAM: https://t.me/HEXcrypto

INSTAGRAM: https://www.instagram.com/HEXcrypto

GITHUB: https://github.com/bitcoinHEX

Komentar

Posting Komentar